Royalty Rate Determination

For many people, the word “royalty” conjures up images of kings and queens basking in wealth and controlling kingdoms. Royalty in everyday business is not unlike those images. Royalties bring wealth to asset owners through various license agreements. These license agreements include the outright sale of an asset, exclusive licenses, and nonexclusive licenses with varying terms. No matter which license type an asset owner chooses, determining an appropriate royalty often proves difficult.

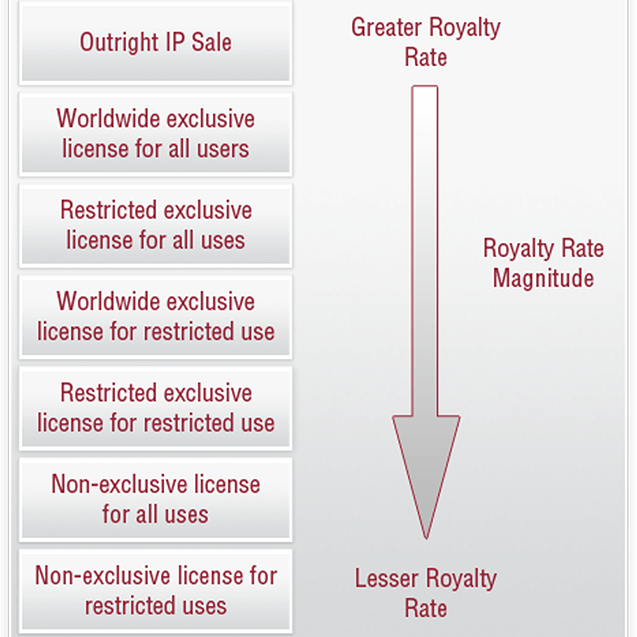

So how much do asset owners charge to license an asset? It depends. In order to determine an appropriate royalty, valuation analysts must take into consideration many factors. As a starting point, they consider the rights the licensor grants to the licensee and the circumstances of the license. The chart gives an indication of the royalty rate magnitude based on license types.

While the chart gives a seemingly simple picture of determining royalty rates, valuation analysts have to consider other factors as well. For instance, the nature of the asset drives the complexity of the royalty rate determination. Therefore, valuation analysts must study the markets for which the product is intended.

How We Help

Establishing royalty rates can be tricky because so many variables exist among numerous approaches and methodologies. Valuation analysts who use reliable approaches spend a remarkable amount of time to produce auditable and defensible royalty rates. At Pellegrino & Associates, our mission is to provide credible valuations and royalty rate determinations. We have the experience and the resources for establishing appropriate royalty rates.

We address the unique facts and circumstances associated with the fields of use for your asset. For instance, one licensee may want to use an asset for some sort of medical device. Another licensee may want to use the same asset in a completely different field for commercial purposes. The value proposition will be different for each field depending on performance, regulatory approval process, and competing solutions. We can help you define the value proposition and determine the value of your asset.

Did you know that there are approximately eight common approaches valuation analysts use to determine a royalty value? Among those approaches, only a few work appropriately as most have remarkable theoretical shortcomings – even among those with broad use. We have diligently studied and analyzed each method and can determine which approach is most appropriate for a given scenario. Don’t rely on the status quo, call us today.

Contact Information

Pellegrino & Associates, LLC

Westfield

1516 W. Tournament Trail

Suite A3

Westfield, IN 46074

Office: 317-566-8199

Toll-Free: 866-822-2300

Engage with us via social media.

Location

Westfield, IN 46074